For 2016 tax returns that are due in 2017, the following due date changes will apply. These changes are effective for the tax years beginning after December 31, 2015 for “calendar” year filers. Below is a comparison of last year’s due date for 2015 and next year’s due dates for 2016 returns:

For Fiscal Year Filers:

- C Corporate tax returns will be due the 15th day of the fourth month after the end of the tax year. A special rule to defer the due date change for C Corporations with fiscal years that end on June 30 defers the change until December 31, 2025 – a full ten years.

- Partnerships and S Corporation tax returns will be due the 15th day of the third month after the end of their tax year. The filing date for S Corporations is unchanged.

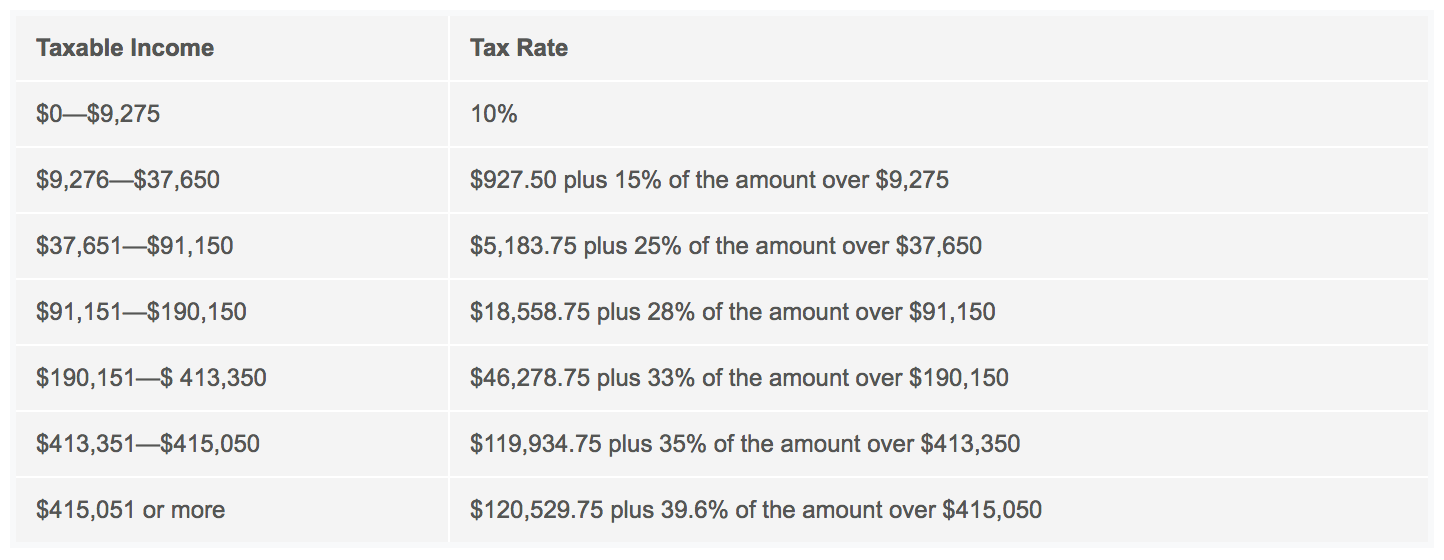

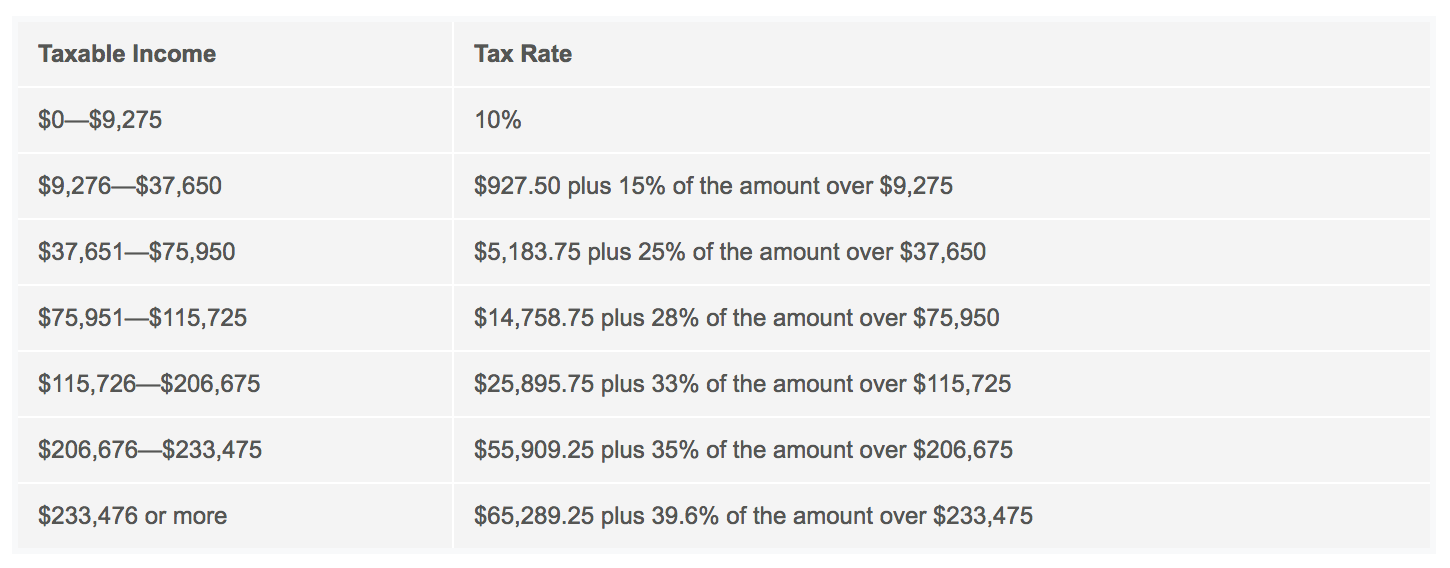

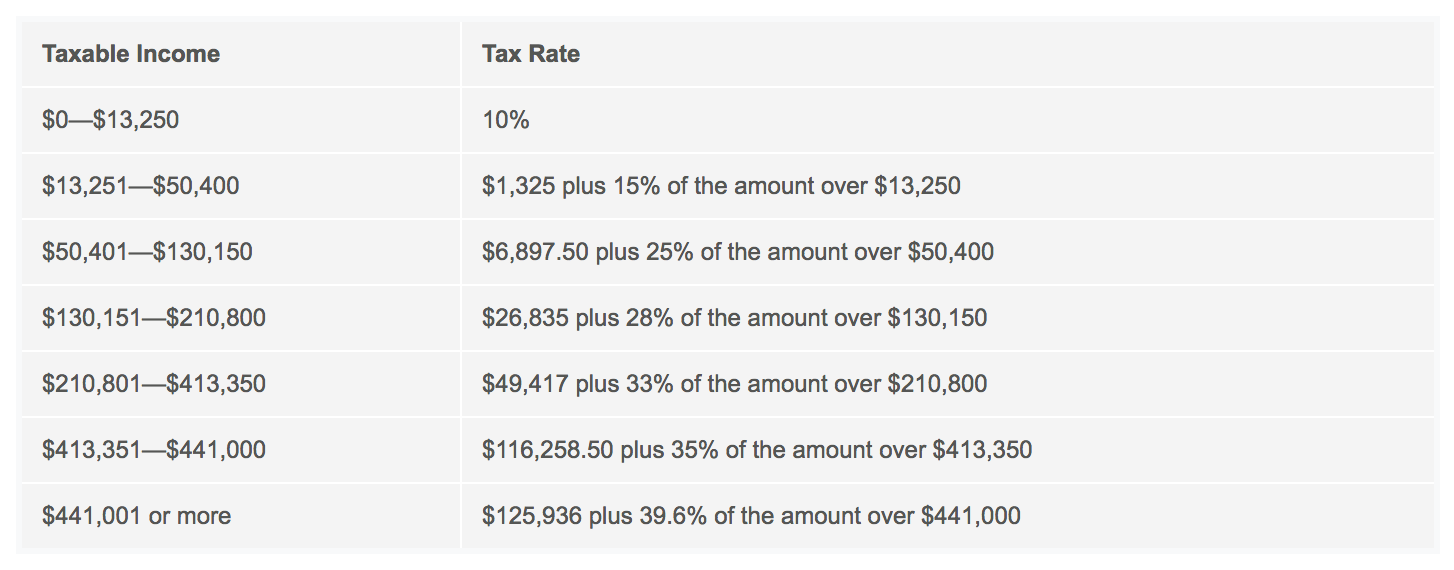

2O16 Federal Income Tax Brackets

The Federal income tax has 7 brackets: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. The amount of tax you owe depends on your income level and filing status.

It’s important to understand that moving into a higher tax bracket does not mean that all of your income will be taxed at a higher rate. Instead, only the money that you earn within a particular bracket is subject to that particular tax rate.

Single

Married Filing Jointly or Qualifying Widow(er)

Married Filing Separately

Head of Household

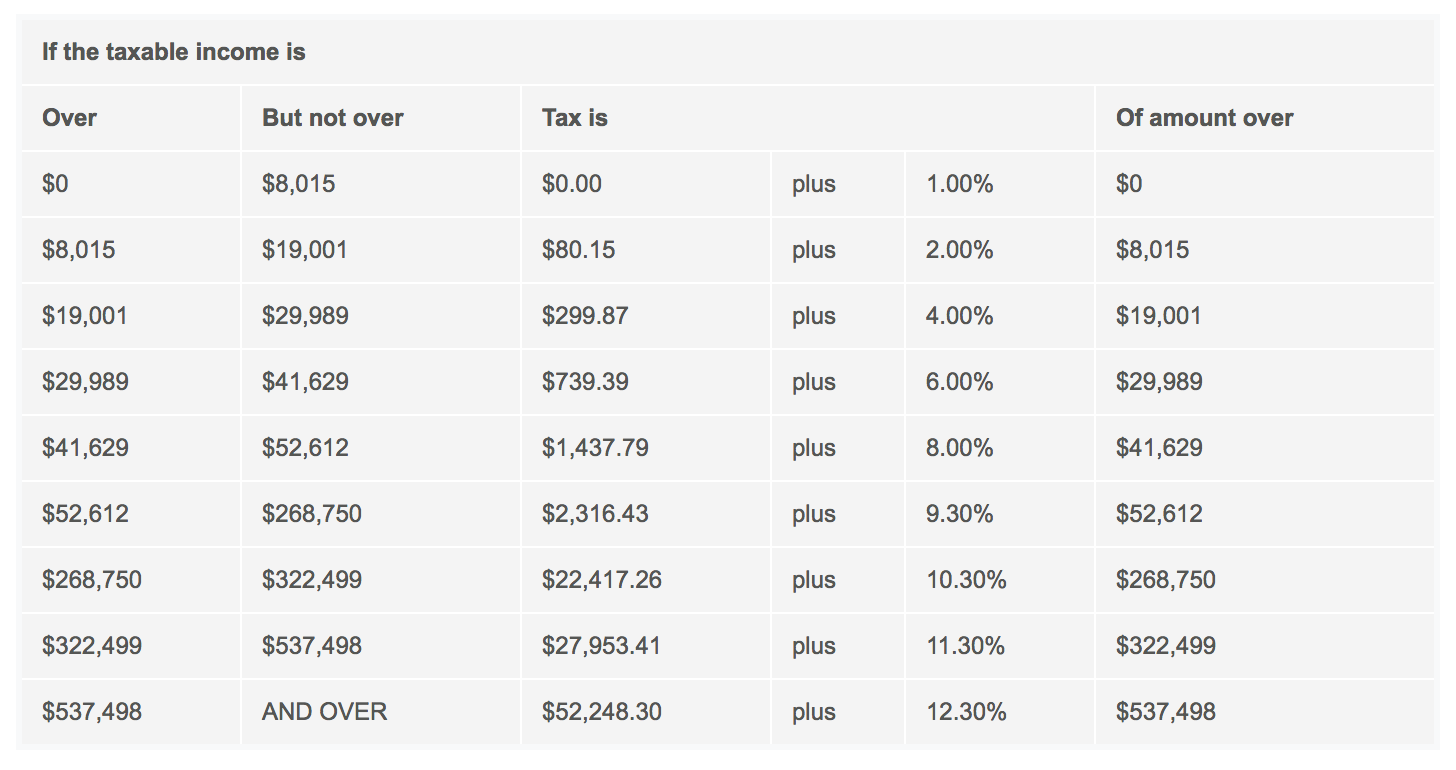

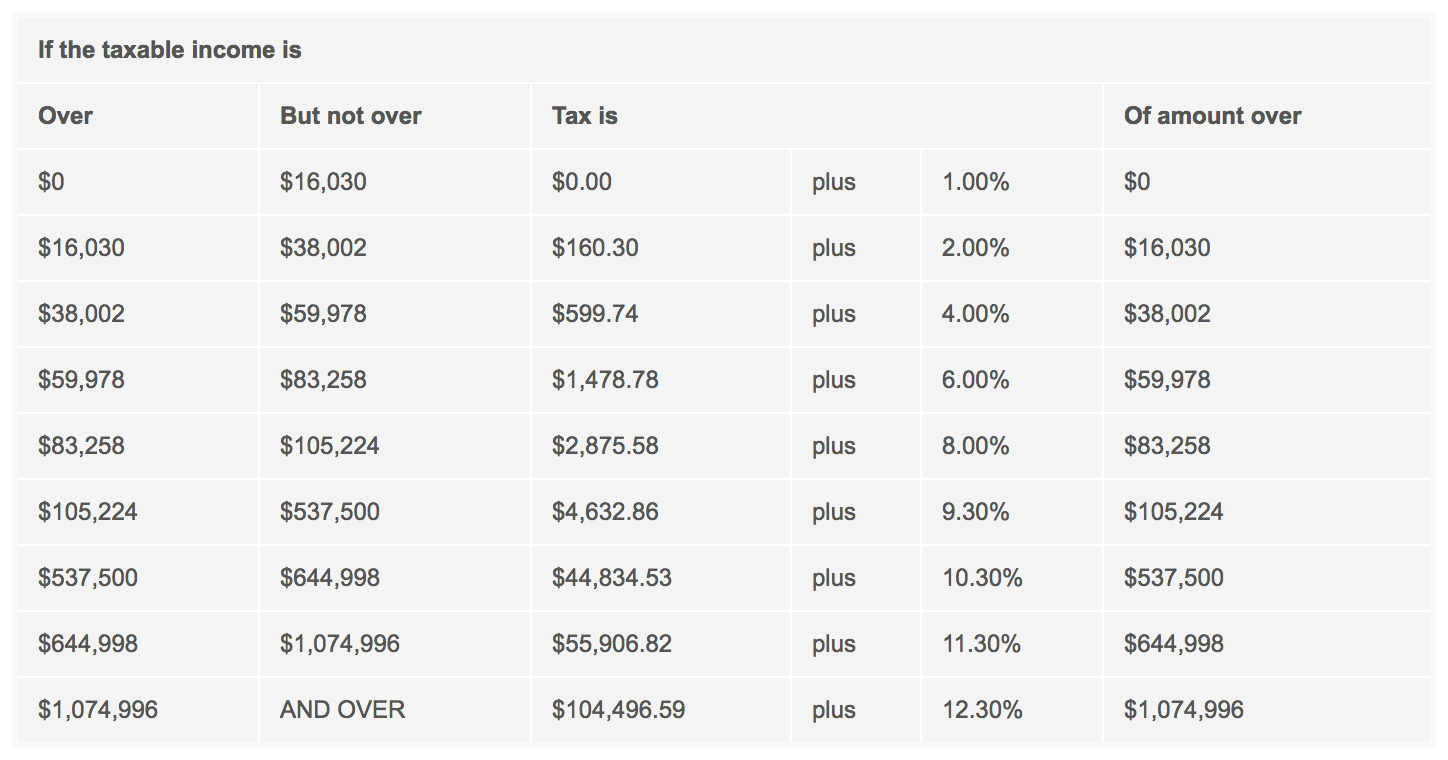

2016 California Tax Rate Schedules

Schedule X — Single or married/RDP filing separately/Fiduciary

Schedule Y — Married/RDP filing jointly, or qualifying widow(er) with dependent child

Schedule Z — Head of household

This article is intended for educational purposes only and is not a substitute for obtaining competent accounting, tax, legal, or financial advice from a certified public accountant, attorney, or other business advisors. You should not act upon any of the information in this article without first seeking qualified professional guidance from your business advisors on your specific circumstances. The information presented should not be construed as advice or guidance from BFBA.