We’ve been fielding numerous questions about the new lease accounting standard, also known as Accounting Standards Update (ASU) 2016-02 (ASC 842), and thought it would be useful to provide you with a frequently asked questions list about ASC 842. The FAQs below are meant to provide you with a high-level understanding of the standard rather than a detailed review of all of the nuances within the new guidance. If you would like to discuss the details that may or may not pertain to you, please don’t hesitate to reach out.

What’s the purpose of the new standard and when is it effective?

In 2006, the FASB, along with the International Accounting Standards Board (IASB), jointly began a project to improve upon the reporting of long-term leases. The hope was to provide for financial statement transparency specifically addressing the off-balance sheet nature of certain leasing transactions. As a result, the FASB issued ASC 842, which requires the vast majority of all leasing transactions to be recorded on the balance sheet.

The new standard is effective for public companies for fiscal years beginning after December 15, 2018. For all other entities, the guidance is effective for fiscal years beginning after December 15, 2021. Early adoption is permitted.

What constitutes a lease?

ASC 842 broadens the lease definition and applies to any contract that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The “right to control” criteria is met if BOTH of the following criteria are met:

- The customer has the right to direct the asset’s use, and

- The customer has the right to obtain substantially all economic benefits from its use during that period.

How is the lease term determined?

The new standard only applies to leases with a duration in excess of 12 months. The term is defined as the non-cancelable period together with all of the following:

- Periods covered by an option to extend the lease if the lessee is reasonably certain to exercise the option

- Periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option

- Periods covered by an option to extend (or not terminate) the lease in which exercise of the option is controlled by the lessor

What are the primary differences when compared to the current standard?

Under the current standard, the critical determination is whether a lease qualifies as an operating lease or a capital lease. Leases are classified as either operating or capital leases depending on whether the lease meets one of the four criteria outlined in the current guidance. Capital leases are then capitalized onto the balance sheet as an asset and corresponding lease liability, and amortized over the shorter of the life of the lease, or the useful life of the asset. Conversely, operating leases have historically been expensed, on a straight-line basis, over the life of the lease.

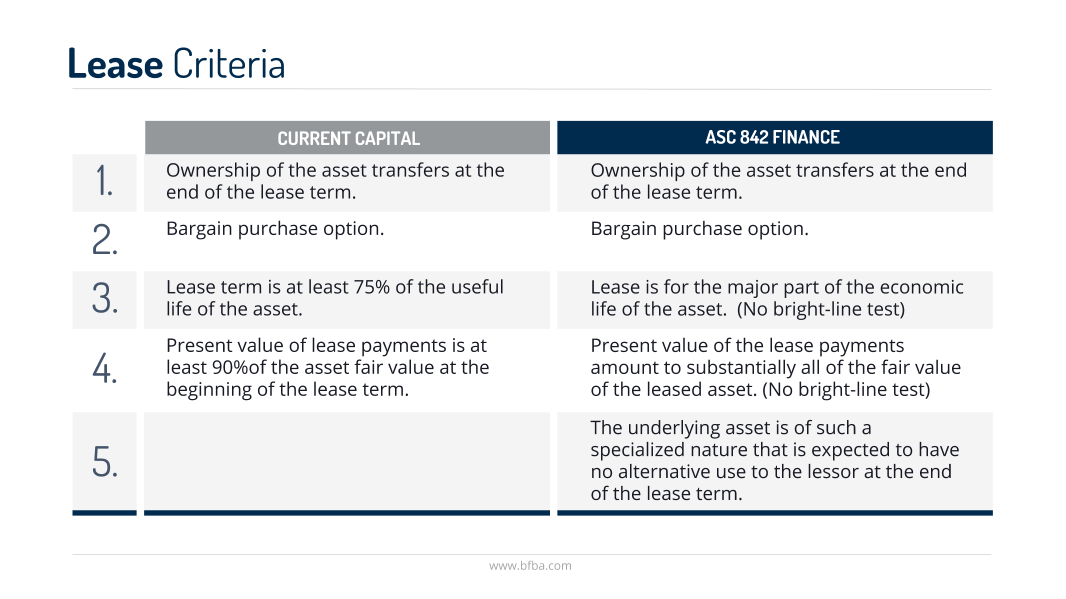

Under ASC 842, the critical determination will be whether or not a lease exists. The new standard classifies every lease as either a finance lease or an operating lease. This determination is very similar to the four criteria that govern today’s capital lease guidance without the bright-line tests (the FASB has added a fifth criteria as well). See table below:

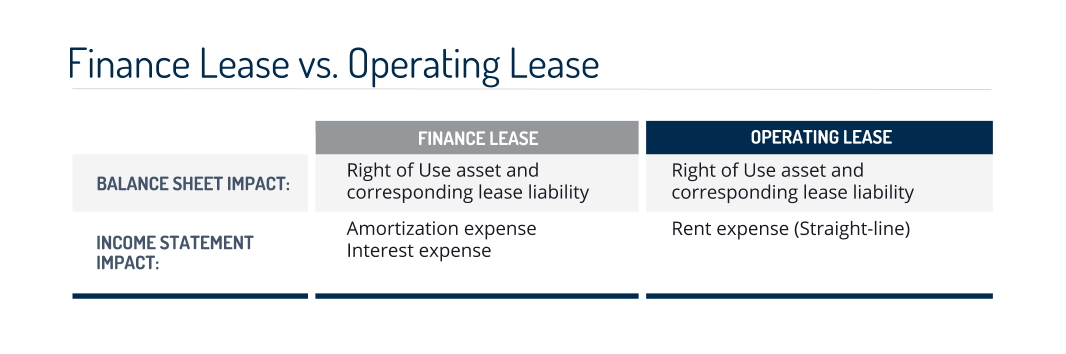

However, regardless of the classification, all leases with terms in excess of 12 months will result in the capitalization of a right of use asset and corresponding lease liability based on the present value of the future minimum lease payments. The major delineation between the finance and operating classification under ASC 842 relates to how the leases are accounted for on the income statement.

The income statement treatment under ASC 842 is similar to that of today’s accounting treatment. Finance leases closely mirror the income statement recognition of today’s capital lease treatment. Companies will amortize the right of use asset to amortization expense, and recognize interest expense related to the lease liability.

Conversely, while operating leases will also require capitalization onto the balance sheet, ASC 842 will require companies to recognize rent expense on the income statement over the life of the lease, on a straight-line basis.

The following table summarizes the differences between finance leases and operating leases:

We have a related party lease, can we adjust the terms to “month-to-month” to avoid the 12 month criteria?

ASC 842 requires that related-party leases be accounted for on the basis of the legally enforceable terms and conditions. However, the stated lease term (month-to-month) would not be factored into the equation as it would be reasonably certain that the lease would be renewed or extended. This concept is highly subjective and requires significant judgement in regards to how long the Company will continue extending the lease. When making this determination, consider such factors as the current leasing market, asset specific advantages, asset modifications made, relocation costs, and other relevant factors.

I am a lessor, how does the new standard pertain to me?

Lessor accounting will remain largely unchanged. However, we recommend that you consult with your CPA regarding the FASB’s new revenue recognition standard (ASC 606) as it pertains to recognizing lease income.

Do you have any advice for implementation?

The new guidance will have an impact on your balance sheet (debt to equity, working capital, etc.). We recommend taking inventory of your contracts to identify which contracts will qualify for the new lease accounting guidance. We recommend working with your CPA to determine the potential impact to your financial statements.

Prospectively, you should create a process that identifies new leases, changes in lease terms, and other contract modifications that may impact the carrying value of the lease on your balance sheet. An entity shall reassess whether a contract is or contains a lease only if the terms and conditions of the contract are changed.

During transition, you are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach.

How are my creditors going to respond to the change in my balance sheet?

Given the nature of the standard and the number of companies that will be impacted, creditors will likely have to adjust their approach to analyzing your ratios and covenants. However, as stated above, we recommend that you proactively approach your creditors with the impact that the standard will have on your specific circumstances.

As always, if you have questions about the new lease accounting standard, or would simply like a second set of eyes at your particular situation, please don’t hesitate to reach out.

This article is intended for educational purposes only and is not a substitute for obtaining competent accounting, tax, legal, or financial advice from a certified public accountant, attorney, or other business advisors. You should not act upon any of the information in this article without first seeking qualified professional guidance from your business advisors on your specific circumstances. The information presented should not be construed as advice or guidance from BFBA.