My daughter played for a nationally ranked, competitive soccer team before she graduated from high school. After almost every game, her coach would gather the team and discuss the highs and lows of their performance. He believes the adage “where performance is measured, performance improves.”

Now that the dust has settled after our first busy season following the historic Tax Cuts and Jobs Act (TCJA), let’s measure some impacts of the new law. In case you missed it, the TCJA is widely considered the most extensive tax modification in the past 30 years. So, with the busy season over, let’s debrief. Who is winning under the new law? Who is losing? And, what have we learned?

It’s Complicated

One stated goal of tax reform was to simplify the US tax system—you may remember President Trump holding up the sample “postcard” tax return. So, was this goal accomplished? The answer to this question depends on your specific situation.

The Tax Foundation (a nonprofit research organization) concluded that tax reform “simplified the tax filing process for millions of households.” By doubling the standard deduction, the TCJA is expected to cut the number of people who itemize their deductions from 47 million to just 18 million; which calculates to only 14% of US households. In addition, changes to the dreaded alternative minimum tax (AMT) have reduced its reach so that fewer taxpayers will be bitten. Finally, The Internal Revenue Service estimates the average time to complete an individual tax return will decrease by 4 to 7 percent.

With that background, simplification was NOT what we experienced at BFBA. The TCJA itself is 1,097 pages of new tax law. In addition, there are more than 3,200 pages of regulations now issued interpreting this law. To complicate matters further, many of these regulations were issued after our busy season had begun. You might say that the rules to the game were changing after we had already started to play.

Tax Liability

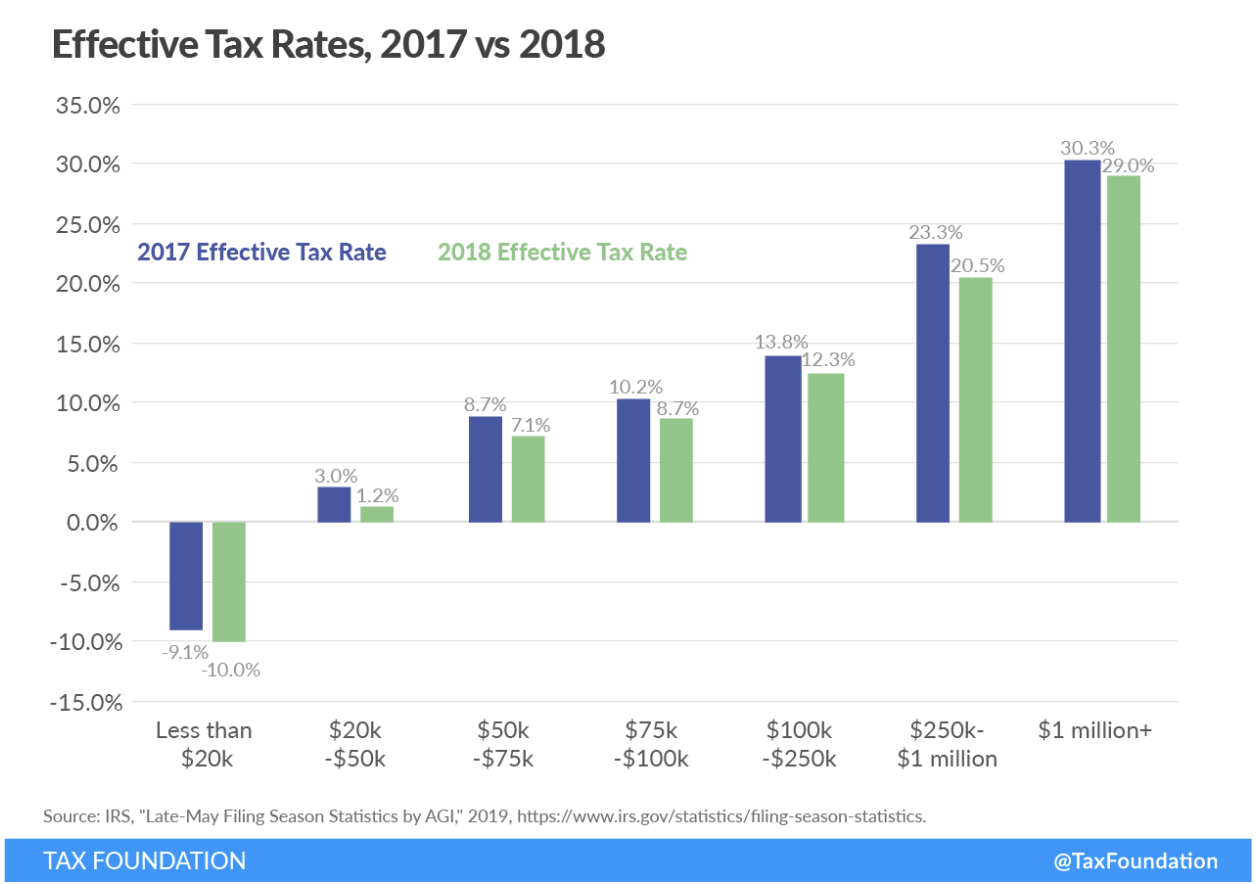

At the end of June, the IRS released the first set of tax return data for 2018. Based on these figures, the Tax Foundation provided the following analysis:

TCJA reduced effective tax rates, or total tax liability divided by an income group’s total adjusted gross income, for all income groups in 2018 compared to 2017. Importantly, even though taxpayers throughout income groups saw a tax cut on average, individual circumstances vary.

Taxpayers making less than $20,000 experienced negative effective tax rates because of refundable tax credits, including the Additional Child Tax Credit (ACTC) and Earned Income Tax Credit (EITC). Refundable tax credits allow taxpayers to receive a refund from the government when the amount of credit… surpasses their tax liability.

While the overall effective tax rates are down, that certainly does not mean that every taxpayer paid less in 2018. The figures in the chart above are only averages. In fact, with the limitation of the SALT (state and local tax) deduction to only $10,000, some of our clients ended up paying more tax this year. Numerous taxpayers in high tax states like California and New York were shocked to discover they owed more.

Other Insights

- Many C corporations are big winners under the new law. With the permanent lower tax rate of 21%, the TCJA delivered on its objective of reducing the tax rate on US companies.

- Internal Revenue Code Section 199A provides a brand new qualified business income (QBI) deduction. This new benefit allows certain taxpayers to deduct up to 20% of their pass-through business income. At BFBA, this aspect of the TCJA was arguably the largest benefit to our clients since many of them are organized as pass-throughs. Some last-minute final regulations limited the deduction a bit, but this one is still “huge” to quote President Trump.

- The TCJA also allowed companies with average annual gross receipts under $25M to reconsider their methods of accounting. From using the overall cash method to the favorable completed contract method for long-term contracts, to eliminate the requirement to track inventory; many accounting method changes can now provide favorable deferrals of tax. This is especially the case now that California has conformed to these changes.

- Section 163(j) potentially limits the amount of interest expense that can be deducted in any given year. The impact of this limit has been larger than we initially expected due to the tax shelter rules and application to affiliated groups. Analyzing the application of this potential limitation has been time-consuming. Additionally, the impact of this limitation is expected to grow as the TCJA phases out the depreciation and amortization deductions in computing Adjusted Taxable Income after 4 years.

Conclusion

As David Floyd of Investopedia puts it, “The polls have shown that how you feel about the $1.5+ trillion overhauls depends largely on your opinion of Trump’s presidency. Individually, how the changes have been felt depends on factors like your income level, filing status and deductions.” The preliminary data indicate that the Tax Cuts and Jobs Act did cut taxes; although individual results may vary.

This article is intended for educational purposes only and is not a substitute for obtaining competent accounting, tax, legal, or financial advice from a certified public accountant, attorney, or other business advisors. You should not act upon any of the information in this article without first seeking qualified professional guidance from your business advisors on your specific circumstances. The information presented should not be construed as advice or guidance from BFBA.