We at BFBA have been busy studying hundreds of pages of new law and newly issued regulations. As tax season gets closer we are fielding more and more questions about tax reform. To help you understand how this law impacts you, we have compiled this list of the most frequently asked questions.

Will I owe more or less tax this year?

The answer to this important question is the age-old it depends. Any time the tax law gets changed, winners and losers are created. The TCJA reduced the tax rates for almost everyone. The highest corporate tax rate went from 35% to 21%. Individual tax rates also decreased; but not as dramatically. Generally, individual rates are lower by 2% to 3%. These changes should benefit most taxpayers.

On the deduction side of the equation, many limitations were introduced. It’s no secret that with the $10,000 limitation on the deduction for state and property taxes, many taxpayers in high tax states like California may end up owing more. The deduction for California income taxes was a large one for BFBA clients.

In short, the TCJA made so many changes that every taxpayer’s situation must be evaluated individually to determine the impact.

Should I become a C corporation to take advantage of the lower 21% rate?

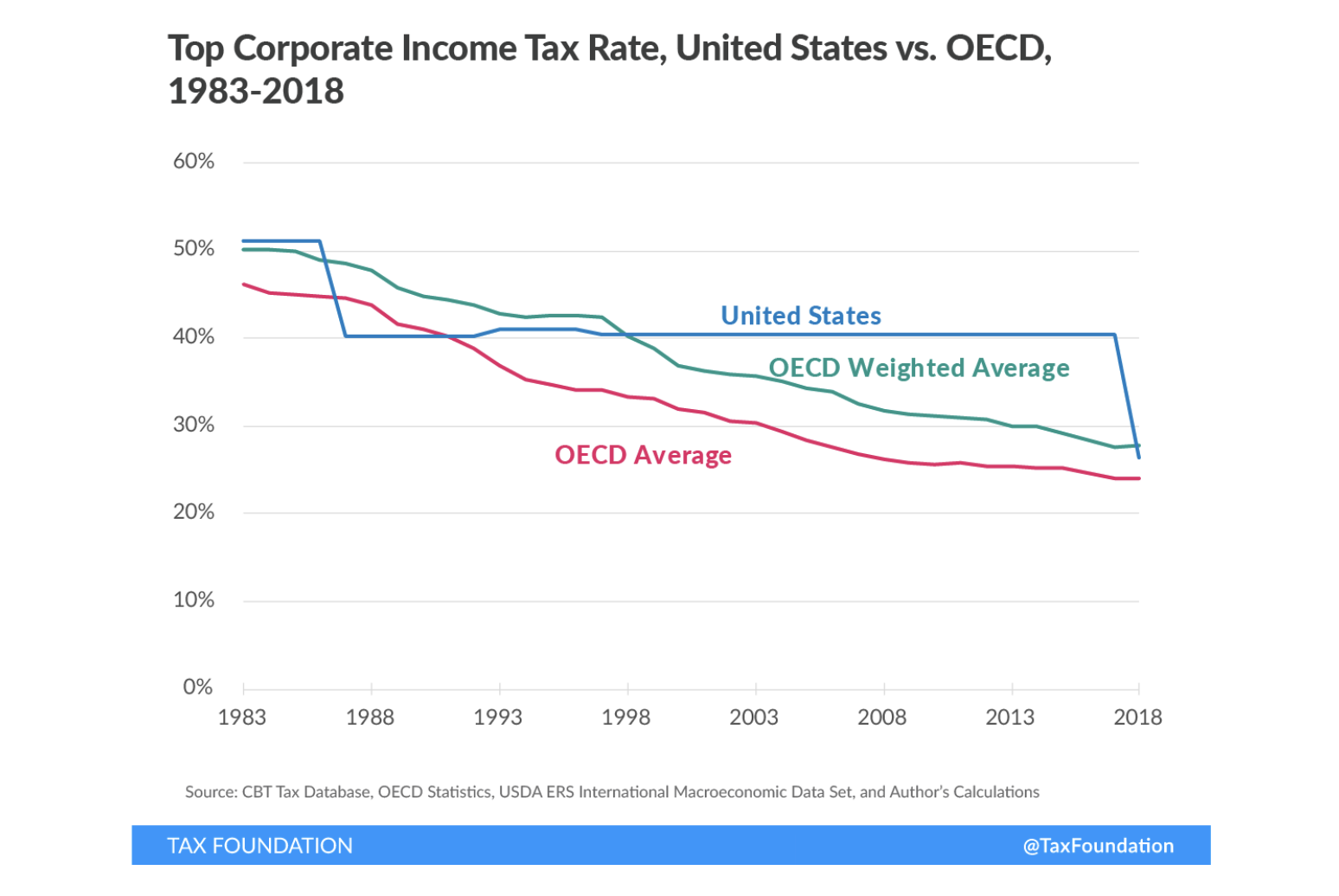

The reduced tax rate for corporations is perhaps the biggest benefit under the tax reform changes. This aspect of the TCJA was designed to help US multi-national companies become more competitive in the global economy.

For many smaller companies organized as C corporations, this 14% reduction in tax rate has been a windfall to profits. This has encouraged many of our clients to ask if they should revoke their S corporation election or even become a C corporation to take advantage of this benefit.

While it does sound appealing, you must remember the key difference between C corporations and other forms of business organizations like S corporations, LLCs, and partnerships (flow-through entities). That key difference is double taxation! C corporations pay tax on their profits and then the owners pay a second, additional, layer of tax on the profits when they are distributed as dividends. While the reduction in the corporate rate has lessened the ultimate difference in tax, it generally remains more expensive to be a C corporation over the long run. This applies even more if your business qualifies for the new 20% pass-through deduction.

Do I qualify for the new 20% pass-through deduction?

One of the most discussed provisions of the TCJA is the new 20% pass-through deduction. Both because it provides a substantial benefit to qualifying taxpayers and because of the uncertainty surrounding who does and who does not qualify for this deduction. The IRS spent eight months drafting the proposed regulations for this new deduction and while some questions were answered, many others remain.

Here is what we know:

- You must be a pass-through entity or sole-proprietorship. The vast majority of US businesses meet this definition. This deduction is not available to C corporations.

- You can deduct 20% of your qualified business income. Qualified business income means business income connected with conduct of a U.S. trade or business (note that some service businesses do not qualify as discussed below). This results in a 20% reduction in the tax rate on this income. For example, in the highest tax bracket of 37%; the 20% deduction reduces your tax rate on the qualifying income to 29.6%.

- For business owners with income below specified thresholds ($157,500 for single taxpayers and $315,000 for married filing jointly), the 20% deduction is limited only by the overall cap of 20% of the taxpayer’s taxable income (excluding capital gains).

- For higher-earning taxpayers, the deduction is limited or eliminated in two important respects.

- First, income from a broad category of service business will not qualify for the deduction. This includes businesses in the fields of health, law, accounting, actuarial science, consulting, performing arts, athletics, and financial services.

- Second, for all other businesses, the 20% deduction cannot exceed the greater of (a) 50% of wages that the business paid in the year, or (b) 25% of wages paid plus 2.5% of the unadjusted basis of business property. Thus, the deduction is designed to most reward labor and capital intensive flow-through businesses.

In short, this new deduction can be extremely complicated and requires detailed analysis to correctly calculate the tax. In addition, planning opportunities abound that can significantly increase the benefit.

How much can I deduct for equipment I purchase or fixed asset additions?

The TCJA has significantly increased the amount of §179 expensing and bonus depreciation available to taxpayers. The following table summarizes these changes:

| Old Law | Law Under TCJA | |

| §179 Expensing Election | Taxpayers could elect to expense $510,000 for the cost of qualifying property placed in service during the tax year.

The amount is reduced when qualifying property placed in service during the tax year exceeds $2,030,000. |

Taxpayers can now elect a maximum amount of up to $1,000,000; nearly double the previous limit.

The phase-out threshold increases to $2,500,000. The group of qualifying assets now includes roofs, HVAC systems, security systems, fire alarms, and other improvements to an eligible property. |

| Bonus Depreciation | The first year depreciation deduction for qualifying assets with a life less than 20 years was augmented by a 50% deduction of the original cost of the property. | Now the bonus depreciation deduction is 100% for assets acquired and placed in service after September 27, 2017, and before January 1, 2023.

The law was also changed to now allow used property to qualify for bonus depreciation. This 100% amount phases down by 20% a year between 2023 and 2027. |

These two provisions combined provide many of our clients with almost a limitless amount of flexibility in determining their depreciation deduction and ultimately their taxable income.

Many additional questions and planning opportunities are available as a result of this massive change to the US tax structure. The questions above are only a few of the most common ones we are seeing. Please contact us to see if we can assist you with applying the new law to your unique situation.

This article is intended for educational purposes only and is not a substitute for obtaining competent accounting, tax, legal, or financial advice from a certified public accountant, attorney, or other business advisors. You should not act upon any of the information in this article without first seeking qualified professional guidance from your business advisors on your specific circumstances. The information presented should not be construed as advice or guidance from BFBA.